I earn up to $70,000 monthly from Cxdai

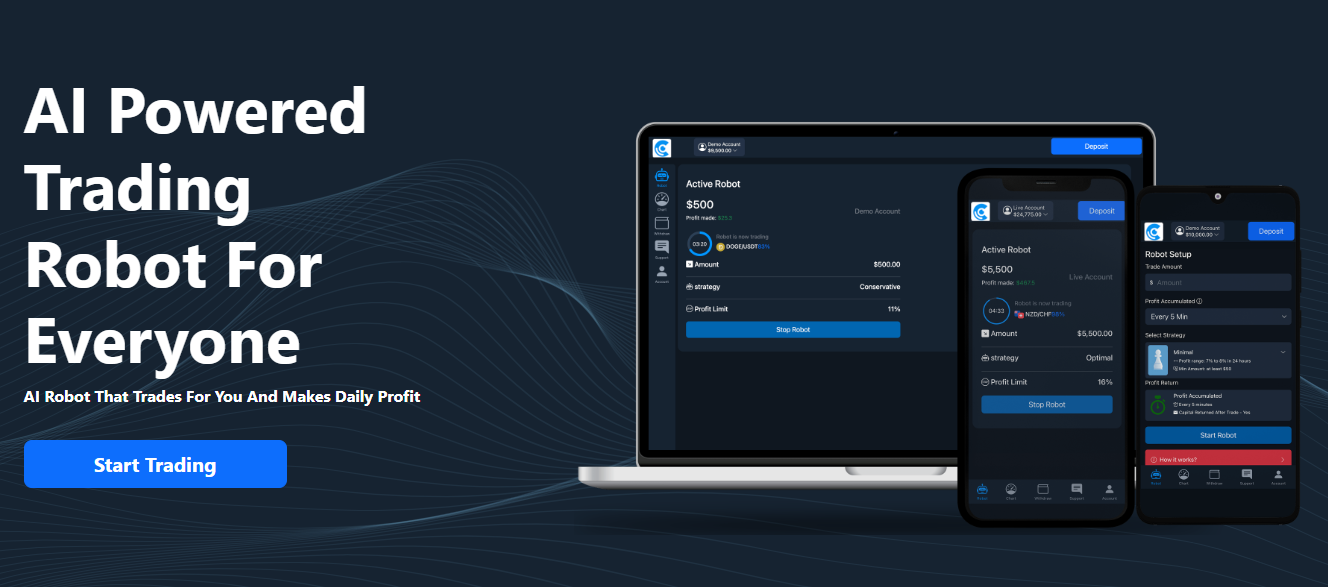

In the fast-paced world of financial markets, traders are continually seeking innovative solutions to enhance their trading strategies. Among these solutions, trading robots have emerged as a powerful tool for both novice and experienced traders. But what exactly are trading robots, and how can they transform your trading experience? In this article, we will explore the functionalities, advantages, and potential pitfalls of using a trading robot, as well as tips on how to select the right one for your needs.

What is a Trading Robot?

A trading robot, often referred to as an automated trading system or algorithmic trading software, is a computer program that uses algorithms to analyze market data and execute trades on behalf of the user. These systems are designed to operate 24/7, monitoring the markets and making trades based on predefined criteria. Trading robots can operate on various financial instruments, including stocks, forex, commodities, and cryptocurrencies.

How Do Trading Robots Work?

Trading robots utilize complex algorithms that analyze vast amounts of market data in real-time. They identify patterns, trends, and potential trading opportunities by employing technical indicators and various analytical tools. Once the robot identifies a suitable trade opportunity, it can automatically execute buy or sell orders based on predetermined parameters set by the trader.

The primary components of a trading robot include:

-

Market Analysis: The robot continuously scans the market, collecting data on price movements, trading volume, and other critical indicators.

-

Strategy Implementation: Traders can program the robot with specific trading strategies, such as trend-following, arbitrage, or mean reversion. These strategies dictate how the robot should react to market changes.

-

Trade Execution: Once the robot identifies a trading opportunity that meets the set criteria, it executes the trade on behalf of the user, ensuring quick and accurate order placement.

Advantages of Using Trading Robots

1. Automation and Efficiency

One of the most significant advantages of using a trading robot is the ability to automate trading processes. This automation eliminates the need for constant monitoring of the markets, allowing traders to free up their time for other activities. The robot can execute trades with precision and speed, often faster than a human trader.

2. Emotion-Free Trading

Trading decisions are often influenced by emotions, leading to impulsive actions that can result in losses. Trading robots operate based on algorithms and predefined criteria, eliminating emotional biases. This objectivity can lead to more consistent trading results.

3. Backtesting Capabilities

Many trading robots come equipped with backtesting features, allowing traders to evaluate the effectiveness of their strategies using historical data. This capability enables users to refine their strategies before deploying them in live trading environments, potentially improving overall performance.

4. 24/7 Market Monitoring

Financial markets operate around the clock, and trading robots can monitor them continuously without the need for breaks. This constant vigilance ensures that traders do not miss potential trading opportunities, regardless of time zone differences or personal schedules.

5. Accessibility for All Traders

Trading robots make it easier for novice traders to enter the market. With user-friendly interfaces and automated processes, even those without extensive trading knowledge can leverage the power of algorithmic trading.

Potential Pitfalls of Trading Robots

1. Over-Reliance on Automation

While trading robots offer significant benefits, over-reliance on automation can be risky. Markets are inherently unpredictable, and no algorithm can guarantee profits in all conditions. Traders should remain vigilant and regularly assess the performance of their trading robots.

2. Technical Issues and Bugs

Like any software, trading robots are not immune to technical issues. Bugs or connectivity problems can lead to missed trades or incorrect execution. Traders should ensure they are using reliable software and be prepared to intervene if necessary.

3. Lack of Market Understanding

While trading robots can analyze data and execute trades, they do not possess the intuitive understanding of market dynamics that experienced traders may have. Relying solely on a robot without understanding the underlying market conditions can lead to suboptimal results.

4. Costs and Fees

Many trading robots come with associated costs, whether through subscription fees, commissions, or performance-based fees. Traders should carefully evaluate these costs to ensure they do not outweigh the potential benefits.

Choosing the Right Trading Robot

Selecting the appropriate trading robot is crucial for achieving success in automated trading. Here are some essential factors to consider:

1. Performance History

Examine the historical performance of the trading robot. Look for verified results and user testimonials that demonstrate its effectiveness over time. Reliable software often provides transparent performance reports.

2. User Reviews and Reputation

Research user reviews and the reputation of the trading robot provider. Consider joining online trading communities to gather insights from other traders who have used the software. A positive reputation is often indicative of a reliable trading robot.

3. Customization Options

The ability to customize the trading robot's strategies is vital. Look for software that allows you to tailor the algorithms to your specific trading style and risk tolerance. Flexibility can significantly impact your trading success.

4. Customer Support

A responsive customer support team is essential, especially for those new to automated trading. Ensure that the trading robot provider offers adequate support channels to address any issues or questions.

5. Cost Structure

Understand the cost structure associated with the trading robot. Determine whether it operates on a subscription model, performance fees, or other pricing strategies. Weigh these costs against the potential returns to assess overall value.

Conclusion

Trading robots are revolutionizing the way traders engage with financial markets, offering automation, efficiency, and the ability to execute trades based on data-driven strategies. While they present several advantages, traders must remain mindful of potential pitfalls and choose their trading robots carefully. By understanding how trading robots work and evaluating the options available, you can leverage this technology to enhance your trading experience.

For more insights and resources related to trading, visit Cxdai.com. Embrace the future of trading with the right tools and strategies, and take your trading to the next level.

Get started with>>> Cxdai.com here.

- Questions and Answers

- Opinion

- Story/Motivational/Inspiring

- Technology

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News

- Culture

- War machines and policy