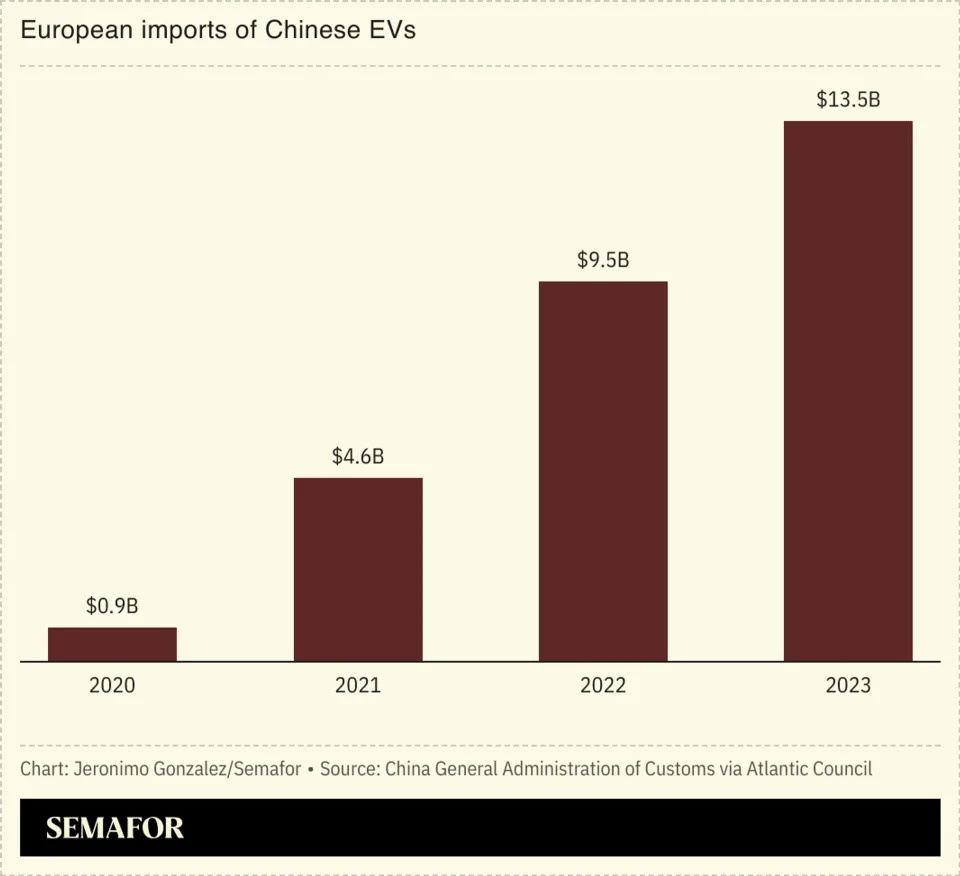

One in five of all electric vehicle imports to Europe in the first four months of 2024 were made in China, according to car sales tracking data reported in the Financial Times. European sales of Chinese EVs jumped by 23% in the first four months of the year compared to the same period in 2023. Between January and April, 119,300 Chinese EVs were registered in the UK and western Europe.

Europe has imposed far lower tariffs on Chinese EV imports than the US, 10% compared to 100%, however lawmakers in the bloc have opened an investigation into the imports that could curb them in the future.

Low prices and jazzy features make Chinese EVs an attractive buy

Chinese EVs are significantly cheaper than European ones and offer more features as standard. In 2023, the average price of a European EV was about $50,000, while a similar vehicle made by Chinese carmaker BYD cost around $32,000. Part of the reason why is to do with domestic trends in China: There, consumers are “more discerning” and care more about style and technology, an analyst told NPR, pushing China’s automakers to add special features like assisted driving to cars. But despite the growth, European consumers still have limited awareness of Chinese brands, which one HSBC analyst told the FT may slow China’s gains.

Europe and the US need China’s green tech to transition from fossil fuels

While Europe and the US have introduced measures to curb Chinese EV imports, a green-energy transition without China would prove difficult, analysts said. China dominates the global green tech market: Energy intelligence firm Wood Mackenzie estimates that in 2023, China installed more than double the solar panels than the US and Europe combined. Europe lacks both the capital and the technical ability to face the transition alone, an analyst told Nikkei Asia. And without China, the cost reduction of renewable energy sources that we’ve become accustomed to in the past decade would end, Wood Mackenzie warned.

Europe is a ‘critical market’ for China as it focuses on exports

Economically, China is going through a “painful” but “necessary” transition as it moves away from relying on the property sector for growth to focus more on high-end manufacturing exports, like lithium batteries, solar panels, and EVs, a China researcher wrote for UK policy institute Chatham House. Europe is a “critical market” for the export of these goods. But the concerns of European policymakers about competition with local manufacturers and potential job losses stemming from that will continue to be a point of tension, the analyst warned.

AfriPrime App link: FREE to download...

https://www.amazon.com/Africircle-AfriPrime/dp/B0D2M3F2JT

Chinese carmakers brace for EU tariffs on electric vehicles from July 4

The European Commission is expected to levy provisional duties on made-in-China electric vehicles from July 4, EU officials told Chinese carmakers on Monday.

An EU investigation into subsidies in China's EV industry has threatened to tear new ruptures in an already tense bilateral relationship. The commission is expected to inform companies privately next week about the level of import duty that will be applied.

A Chinese automobile association met with the bloc's department of trade in Brussels on Monday for a hearing on the probe, according to people familiar with the meeting. During this hearing, businesses were told to expect provisional duties on July 4, although no tariff rate was disclosed.

It is understood that Chinese businesses affected have sought legal advice on the commission's apparent decision to apply tariffs without communicating the rate four weeks before they take effect, as is customary in the EU.

It was previously expected that the rate would be disclosed on Wednesday, June 5. After July 4, the commission has four months to turn the provisional duties permanent, in consultation with member states.

The investigation has put more strain on the EU-China relationship. Photo: AFP alt=The investigation has put more strain on the EU-China relationship. Photo: AFP>

"This is an ongoing investigation, we are not going to comment on it. We will be in a position to announce some provisional elements on it quite soon," said Olof Gill, the EU's trade spokesman.

The saga has infuriated Beijing, and dominated discourse on EU-China relations for months.

The probe was launched in October, with European Commission President Ursula von der Leyen warning of a "flood" of Chinese EV imports coming to Europe, which she said could decimate the continent's automotive industry in the same way its solar sector was all but wiped out a decade earlier.

Since then, the ins and outs of the inquiry have been debated ad nauseam. Supporters want higher duties to deter Chinese imports, an argument that has united securocrats, who fear the data harvesting potential of EVs, and economic nationalists, who want to protect the EU's industry.

Free-traders and environmentalists, on the other hand, have formed an unlikely alliance against duties, arguing that they would distort markets and derail the bloc's efforts to wean itself off combustion engine cars and thus decarbonise.

Powerful elements in Germany too have emerged in opposition to the duties, with its own car companies also on the hook for higher costs in shipping their vehicles made in China back to Europe. German diplomats have been lobbying against the tariffs in Brussels, while Chancellor Olaf Scholz has publicly questioned the probe.

Now, Brussels faces a challenge in applying a countervailing duty that would balance out the level of subsidies they have found in the Chinese economy and level the playing field for domestic car companies, while also not appearing to abandon its commitment to the EU's Green Deal.

A cottage industry of analysis has sprung up around the investigation, with experts scrambling to predict the level of duty that will be applied - but also attempting to forecast the response from Beijing, and gaming out the steps of what many expect will be a tit-for-tat trade war.

Regardless of the rate they land on, they are bound to upset some stakeholders. Some may gripe that if the rate is too low, it will incur a response from Beijing without restricting the flow of imports.

China has fumed not just at the prospect of duties, but at the very idea of the investigation.

A five-page letter mailed to the EU's trade chief Valdis Dombrovskis threatened to go after EU aviation and food exports. Brussels sources said the letter contained no serious proposal for ending the feud, which could only be resolved on a technical basis, by addressing the underlying subsidies.

It was seen internally as a way of ginning up opposition to the probe among EU member states.

Before the letter was first reported by Politico, stories emerged that the commission would delay informing the exporters of the level of duty until after this week's European Parliament elections. The suspicion is that Beijing could have hiked duties on sensitive agricultural products ahead of the polls, potentially skewing the vote.

It is this course of action that prompted Chinese businesses to seek legal advice.

"Instead of postponing the decision, the EU Commission should stop the probe ASAP. China stands ready to safeguard businesses' lawful rights and interests," the Chinese foreign ministry's top Europe official Wang Lutong wrote on X in response to the delay.

Analysts at Rhodium Group have found that a tariff rate below 50 per cent would be unlikely to deter all Chinese EV imports and protect the EU's industry, given that other markets have higher duties. The United States, for example, slapped a 100 per cent import tax on the cars last month - an effective ban.

The average historical countervailing duty applied by EU authorities is 19 per cent, while there is currently a 10 per cent import duty on the cars.

Research published last week by the Kiel Institute for the World Economy, a German research institute, showed that a 20 per cent tariff on Chinese EVs would result in a US$3.8 billion drop in EU EV imports from China, roughly 25 per cent of the current value of trade. Sales of domestically produced EVs would rise by US$3.3 billion, the study found.

Beijing also faces a balancing act in deciding how to respond. Commerce Minister Wang Wentao and Ling Ji, the commerce vice-minister, are currently touring Southern European countries, with the EV probe high on the agenda in both Spain and Greece.

"If the European side does not live up to its words and continues to suppress Chinese enterprises, China will take all necessary measures to firmly safeguard the legitimate interests of Chinese enterprises," read a Chinese commerce ministry statement after Wang met with businesses in Spain on Sunday.

So far China has threatened, through official, media and business sources, to target EU pork, dairy produce, large engine cars, and aircraft, while also launching an anti-dumping probe into imports of EU-made brandy.

"Beijing is signalling its readiness to use highly visible tools to put pressure on member states that it hopes can influence the course of EU trade policy. The threats are aimed at France (agricultural and aerospace products) and Germany (cars), the two biggest EU member states," read a note from Rhodium.

"France has been supportive of the commission, and Beijing is sending a signal to Paris that there will be a price to pay for this support. Germany has voiced doubts about the EV probe, and by threatening Berlin, Beijing likely hopes to encourage Chancellor Olaf Scholz's government to push back more forcefully," it read.

AfriPrime App link: FREE to download...

https://www.amazon.com/Africircle-AfriPrime/dp/B0D2M3F2JT

Should VW Offer Its €20,000 EVs in the US and Canada?

-

VW plans to launch four entry-level EV models in Europe starting in 2027, from Cupra, Škoda, and VW brands, including two compacts and two crossovers.

-

The entry-level EVs are slated to have a starting price around €20,000, or $21,800 at the current exchange rate.

-

VW is expected to face significant pressure from Chinese brands in multiple EV segments in Europe in the coming years, as Chinese automakers continue to introduce their vehicles to the continent.

While Chinese automakers already are offering much more affordable EVs and the $25,000 Tesla model may have fallen victim to inflation—a development Tesla CEO Elon Musk has denied—Volkswagen has greenlit an even more ambitious electric car project than the one once teased by Tesla.

A few days ago the Board of Management of the Volkswagen Group said it will launch not one but four EVs with a target price of around €20,000, or $21,800 at the current exchange rate.

"Two new compact cars, one from VW and one from Cupra, as well as two small crossovers—one each from Škoda and one from VW—are planned here," the VW Group said in a statement.

Described as compact and particularly inexpensive EVs, the Electric Urban Car Family models are slated to arrive in 2027, at least in Europe. And all four will be built in Spain.

As such, they would undercut the already compact and relatively inexpensive VW ID.3 that has been on sale in Europe for a number of years.

"Generations of people associate the strong brands of the Volkswagen Group with their first car—and with affordable mobility," said Oliver Blume, CEO of Volkswagen Group. "As a group with strong brands, we continue to assume this social responsibility to this day."

While a gradual drop in EV prices had been foreseen for some time, it's not lost on industry observers that Volkswagen will also go up against a number of affordable models from Chinese automakers by 2027.

As such, Wolfsburg will fight for a slice of the market that Chinese automakers appear poised to capture in Europe and elsewhere in the coming years, in price segments that had not seen EV entries for a variety of reasons.

However, the VW Group did not indicate whether any of the four would be offered in the US or Canada, despite announcing plans for the Cupra brand to enter the US later in the decade. Likewise, VW did not bring the ID.3 stateside after its launch five years ago, opting for larger offerings like the ID.4 as well as the ID. Buzz that will arrive later this year.

Days ago VW also postponed plans to bring the ID.7 sedan stateside—at least for now. The ID.7, aimed pretty squarely at the Tesla Model 3, has launched in Europe along with its station wagon twin.

As such, we're not expecting VW to offer any of these four models stateside, at least not at first, continuing the trend of small and affordable EVs largely passing us by.

VW's hesitation is perhaps understandable, as small electric hatches have faced an uphill battle in the US for the past decade and a half, with vehicle shoppers gravitating toward midsize sedans and crossovers even in the recent "modern era" of EVs. The VW brand itself has noticeably stretched upmarket over the past two decades when it comes to pricing.

The rising cost of materials—a more recent trend—has also eroded the business case for smaller and more affordable cars for many automakers, complicating VW's mission for 2027.

"Despite the attractive price, our vehicles will set standards in the entry-level segment in terms of technology, design, quality, and customer experience," said Thomas Schäfer, CEO of the Volkswagen brand. "This task has become more demanding due to rising energy, material, and raw material costs."

By 2027 the €20,000 target may well be even more challenging for VW to achieve, thanks to inflation and the ever-growing cast of competitors. But this won't quite address the dearth of truly affordable electric cars on this side of the Atlantic.

Should VW bring its entry-level EV here, or will the US market be more receptive to larger and more luxurious crossovers and SUVs in the second half of the decade? Let us know what you think in the comments below.

AfriPrime App link: FREE to download...

https://www.amazon.com/Africircle-AfriPrime/dp/B0D2M3F2JT

GWM to close European base

Chinese automaker Great Wall Motor (GWM) said it planned to close its main European headquarters, in the Munich, Germany in August in response to sluggish sales in the region.

The Hong Kong listed automaker said it would lay off around 100 staff employed at the site, which was opened just three years ago, due to sluggish demand.

The company sold just 6,300 vehicles in Europe last year, equivalent to just 2% of its overseas sales and a small fraction of its 1.23m global sales.

The decision to close the headquarters came just days ahead of an expected announcement by the European Union to impose tariffs on Chinese made electric vehicles to protect the region’s automakers from imports which it claims benefit unfairly from Chinese government subsidies.

GWM was also understood to have shelved plans to establish local production and R&D operations which it had announced when it first opened its Munich base.

The company said it was “adjusting its European strategy as the region’s electric vehicle (EV) market becomes more challenging”.

According to local reports, GWM did not intend to exit Europe but it was scaling down its operations to bring them more in line with its sales volume.

Sales and aftersales operations in Europe in future would be managed from its global headquarters in China’s Hebei province.

"GWM to close European base" was originally created and published by Just Auto, a GlobalData owned brand.

AfriPrime App link: FREE to download...

https://www.amazon.com/Africircle-AfriPrime/dp/B0D2M3F2JT