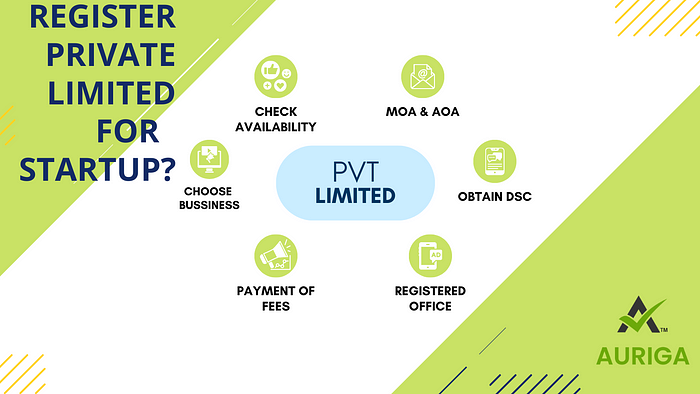

How do I register a private Limited company for a startup?

Choose a Business Name, Check Availability, Drafting Memorandum, and Articles of Association, Appoint Directors and Shareholders, Registered Office Address, Obtain Digital Signatures, File for Incorporation, Payment of Fees, Receive a Certificate of Incorporation

Registering a private limited company for your startup involves several steps. Keep in mind that the process may vary depending on the country you're in. Below is a general guide that you can follow:

1. Choose a Business Name:

Select a unique and appropriate name for your company. Ensure it complies with the naming guidelines of your country's business registry.

2. Check Availability:

Verify the availability of the chosen name with the business registrar to ensure it's not already in use.

3. Drafting Memorandum and Articles of Association:

These are legal documents outlining the company's constitution, objectives, and rules for internal management.

4. Appoint Directors and Shareholders:

Identify and appoint directors and shareholders. Private limited companies often require at least one director and shareholder, and they can be the same person.

5. Registered Office Address:

Provide the registered office address for the company. This is the official address for legal communications.

6. Obtain Digital Signatures:

In some countries, directors and subscribers need digital signatures for filing documents online.

7. File for Incorporation:

Prepare the necessary documents, including the Memorandum and Articles of Association, and file them with the relevant government authority or business registrar.

8. Payment of Fees:

Pay the required registration fees. The amount may vary depending on your country and the type of services offered.

9. Receive Certificate of Incorporation:

Once your application is approved, you will receive a Certificate of Incorporation. This document confirms the existence of your company.

10. Apply for PAN and TAN:

Obtain a Permanent Account Number (PAN) for your company. In some countries, you'll also need a Tax Deduction and Collection Account Number (TAN).

11. Open a Business Bank Account:

Use the Certificate of Incorporation and other relevant documents to open a business bank account in the company's name.

12. Compliance with Tax Regulations:

Understand and comply with the tax regulations applicable to your business. This may include GST, VAT, or other local taxes.

13. Maintain Statutory Records:

Keep records of board meetings, shareholder meetings, and other statutory records as required by law.

14. Obtain Licenses and Permits:

Depending on your industry, you may need specific licenses and permits to operate legally.

15. Compliance with Annual Filing Requirements:

Be aware of and comply with annual filing requirements, such as submitting annual financial statements and tax returns.

16. Seek Professional Advice:

Consider seeking advice from a legal or financial professional to ensure compliance with all legal and regulatory requirements. Auriga accounting helps to register a private Limited company for a startup

Accounting and financial services firms like Auriga Accounting may offer the following assistance during the registration process:

- Business Structure and Planning: Auriga accounting Guide on choosing the right business structure, such as a private limited company, based on the nature and goals of your startup.

2. Name Availability Check: Auriga accounting Assists in checking the availability of your chosen business name and suggests alternatives if needed.

3. Document Preparation: Auriga accounting Helps in drafting and preparing essential documents, including the Memorandum and Articles of Association, which are crucial for the incorporation process.

4. Submission of Documents: Auriga accounting Facilitates the submission of necessary documents to the relevant government authorities for company registration.

5. Digital Signatures: Auriga accounting Assists in obtaining digital signatures if required for online filing

6. Coordination with Authorities: Auriga accounting Communicate with the business registry or government authorities on your behalf, streamlining the registration process.

7. Fees and Payments: Auriga accounting Provides information on registration fees and assists in making the necessary payments to complete the registration process.

8. Follow-Up: Auriga accounting Follow up on the status of your application and address any issues or requests for additional information from the authorities.

9. Post-Incorporation Services: Auriga accountingOffer ongoing accounting, tax, and compliance services to ensure that your company remains in good standing with regulatory requirements.

10. Tax Planning: Auriga accounting Provides advice on tax planning and compliance, helping your startup navigate tax regulations.