The European Union inched forward with its plans to de-risk its relationship with China on Wednesday, unveiling an update to its economic security strategy, but the most controversial elements have been tempered amid resistance from member states.

A senior Brussels official denied that it had been forced to "water down its plans" and insisted the European Commission was determined to push on with the strategy.

The Commission wants to revise rules on vetting foreign investments and set guidelines on academic collaboration to protect European researchers from industrial espionage and foreign interference.

"In 2022 investigative journalists found almost 3,000 scientific collaborations of EU universities with Chinese military institutes since the year 2000," EU competition boss Margrethe Vestager told a press conference.

"This may not have been illegal then. But the question, of course, is: is it desirable? Is this what we want?"

The most controversial elements of the strategy, first proposed last June, have faced opposition from EU member states.

Instead of proposing a law for screening the investments of private instead companies into 10 hi-tech sectors in perceived risky markets like China, Brussels will embark on a series of monitoring exercises, aiming to propose a policy by the end of next year. In reality, it could be many years before any proposal becomes law.

"I would not agree that the package is watered down," EU trade chief Valdis Dombrovskis told reporters. "All the initiatives we announced in June, we are following through in consultation with member states and stakeholders."

Brussels has also been pushing to harmonise member states' export control regimes. A senior EU official, speaking on condition of anonymity, said this was to reduce the risk that "through certain investments, in certain countries, the technology could leak, know-how is passed on and gets into the hands of military intelligence and is used back against us".

But some member states are unwilling to hand these powers over to the Commission. So rather than proposing a law, it has published a white paper "to assess whether current rules can be improved in the face of geopolitical challenges".

Since Commission President Ursula von der Leyen announced plans to de-risk ties with China last March, with outbound investment screening at its core, the commission has become embroiled in a tussle with powerful member states such as France and Germany.

The stand-off highlights concerns about the conflation of national and economic security, in an age when it is getting harder to distinguish between products with civil and military purposes.

As a result, the Commission, which sets trade policy for the bloc, wants to expand its responsibilities to address these concerns - much to capitals' chagrin.

It may also face an uphill struggle to get member states to centralise European export control authority.

Vestager said that the commission was trying to avoid a "turf war" with its members.

"We could have a turf war, we could just suggest that competency moves and then we would have I think a very conflictual discussion about competencies," she said.

"I hope that it is clear that by this sort of step-by-step approach, we are doing what we can in order to work with member states without asking for competences to be moved."

While China has not been named in the discussion on export controls, Brussels sources privately admit they want to stop European technology such as quantum computing and artificial intelligence from strengthening the People's Liberation Army.

The idea is that a Europeanised export controls regime would eventually work in tandem with outbound investment screening to make sure that restrictions on exports to certain countries are not undercut by factories being built or companies bought there.

The commission has suggested "introducing uniform EU controls on new items that were not adopted by the multilateral export control regimes because they were blocked by certain countries, notably Russia".

The current system "creates loopholes that we cannot afford to have", trade chief Valdis Dombrovskis told reporters. "We also see a multiplication of new national controls on emerging and sensitive technologies imposed by some countries."

There is also a determination to break free of the United States' extraterritorial use of export controls.

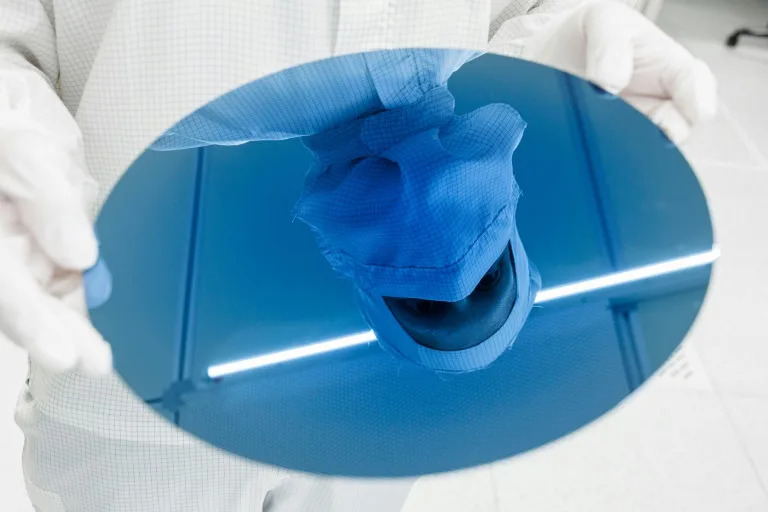

Last year, the Netherlands was forced to comply with US curbs on China, meaning Europe's most valuable tech company ASML had to stop selling high-end lithography machines to Chinese buyers.

EU competition chief Margrethe Vestager said Brussels did not want a "turf war" with member states. Photo: EPA-EFE alt=EU competition chief Margrethe Vestager said Brussels did not want a "turf war" with member states. Photo: EPA-EFE>

The only legislative proposal in the new package is a tightening of existing screening of investments into the EU, which would require all members to vet foreign takeovers to ensure they align with its security interests.

The bloc already has a foreign direct investment screening mechanism, which has been adopted by all but five of its members and was introduced largely in response to Beijing's hoovering up of strategic European tech companies.

But Brussels fears that until it is harmonised, companies in key industries such as robotics, biotech or aerospace could fall into the hands of Chinese or other authoritarian powers.

Under the new proposals, the Commission will focus on "risky transactions" in sectors with military connections or in the 10 critical technologies the bloc named last year. It would also extend the screening to include intra-EU deals where the buyer is not European.

The commission's statistics show that 32 per cent of all investments scrutinised in 2022 under existing mechanisms were American. Just 5.4 per cent were Chinese.

Despite this, concern over Chinese ownership of strategic European infrastructure has risen. Last week, the European Parliament passed a non-binding resolution demanding that European critical assets, such as ports and transport networks, undergo mandatory screening to exclude "suspicious investments from China".

EU tools up to protect key tech from China.

The EU has already proposed new rules aimed at keeping the bloc competitive during the transition to clean technology.

The European Union unveiled Wednesday plans to strengthen the bloc's economic security including measures to protect sensitive technology from falling into the hands of geopolitical rivals like China.

Brussels has bolstered its armoury of trade restrictions to tackle what it deems to be risks to European economic security, following Moscow's invasion of Ukraine and global trade tensions.

The fallout from the war in Ukraine hit Europe particularly hard, forcing the bloc to find alternative energy sources. Now, it wants to avoid a similar over-reliance on China, which dominates in green technology production and critical raw materials.

On Wednesday, EU officials outlined an economic security package containing five initiatives, including toughening rules on the screening of foreign direct investment (FDI) and launching discussions on coordination in the area of export controls.

The EU has already proposed new rules that it says are necessary to keep the bloc competitive during the global transition to clean technology and to bring more production to Europe.

"In this competition, Europe cannot just be the playground for bigger players, we need to be able to play ourselves," said the EU's most senior competition official, Margrethe Vestager.

"By doing what we are proposing to do, we can de-risk our economic interdependencies," she told reporters in Brussels.

Wednesday's package is part of the EU's focus on de-risking but not decoupling from China, pushed strongly by European Commission President Ursula von der Leyen.

"The change in EU-China relations has been the driving force of this embrace of economic security, which is something extremely new for the EU," said Mathieu Duchatel, director of international studies at the Institut Montaigne think tank.

- 'Focus on riskier transactions' -

EU officials also pushed back on claims the package had been watered down and that some of the initiatives would kick in too late.

One of the initiatives is to revise the EU's regulation on screening FDI, but others recommend further discussions, raising concerns that action could come too late.

For example, the commission said it wanted to promote further discussions on how to better support research and development of technologies that can be used for civil and defence purposes.

The EU also wants all member states to establish screening mechanisms, which could later lead to investments being blocked if they are believed to pose a risk.

"I would not agree that the package is watered down," the EU's trade commissioner, Valdis Dombrovskis, said.

He later said the EU wanted "to focus on riskier transactions and spend less time and resources on low-risk ones".

The negotiations are likely to prove a a delicate balancing act for the commission. Investment and export control decisions are up to national governments, therefore it must avoid overstepping its mark.

The package also recommends looking at outbound investments since the bloc currently has zero measures in place to scrutinise them.

The fear is such investments in some advanced technologies "could enhance military and intelligence capacities of actors who may use these capabilities to threaten international peace and security," the commission said, without naming countries.

The commission also proposed that the 27 member states recommend measures to enhance research security at national and sector level.

The importance of European economic security grew after statements by the commission in June, which pointed to rising geopolitical risks in the world including the war in Ukraine. There are also growing trade tensions worldwide causing concern in Brussels.

In October, the EU unveiled a list of four critical technologies -- advanced semiconductors, artificial intelligence, quantum computing and biotechnology -- that present the most sensitive and immediate risks related to technology security and leakage.