Takaful Insurance Market Share and Future Prospects (2024-2030)

The Growing Landscape of Takaful Insurance: A Human-Centric Perspective

The global insurance industry has undergone significant transformations over the years, with innovative models emerging to cater to diverse cultural, religious, and economic needs. One such model is Takaful insurance, a Sharia-compliant alternative to conventional insurance. Rooted in the principles of mutual cooperation, shared responsibility, and ethical investment, Takaful insurance has gained traction not only in Muslim-majority countries but also in regions with diverse populations. This article delves into the Takaful insurance market, exploring its definition, growth drivers, segmentation, and country-level analysis, while humanizing the narrative to reflect its impact on individuals and communities.

Market Estimation & Definition

Takaful insurance Market Share is a unique financial model based on Islamic principles, where participants contribute funds into a pooled system to support one another in times of need. Unlike conventional insurance, which involves elements of uncertainty (gharar) and interest (riba) prohibited in Islam, Takaful operates on the principles of mutual assistance and risk-sharing. The concept is akin to a community-based safety net, where profits are distributed fairly, and investments are made in ethical, Sharia-compliant ventures.

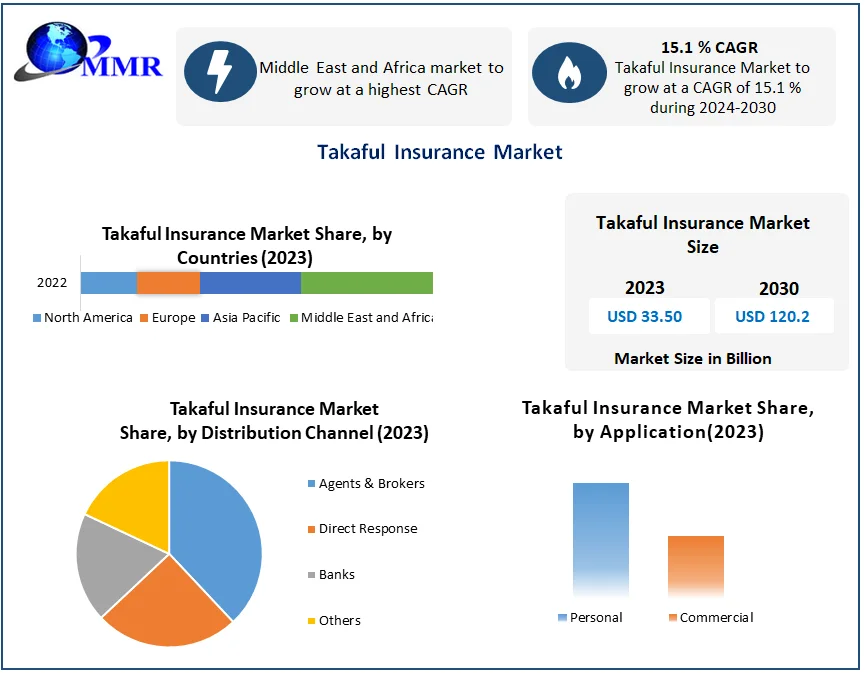

According to Maximize Market Research, the global Takaful insurance market was valued at approximately USD 24.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2029. This growth is fueled by increasing awareness of Islamic finance, rising disposable incomes in Muslim-majority countries, and the ethical appeal of Takaful to a broader audience.

Click Here For Free Sample Report Link:https://www.maximizemarketresearch.com/request-sample/213737/

Market Growth Drivers & Opportunities

1. Rising Awareness of Islamic Finance

The global Islamic finance industry has witnessed exponential growth, with assets exceeding USD 3 trillion in recent years. As more individuals and businesses seek ethical financial solutions, Takaful insurance has emerged as a viable option. The principles of fairness, transparency, and social responsibility resonate not only with Muslims but also with non-Muslims who prioritize ethical investments.

2. Economic Growth in Muslim-Majority Countries

Countries in the Middle East, Southeast Asia, and Africa are experiencing rapid economic growth, leading to increased disposable incomes and a growing middle class. This demographic shift has created a fertile ground for Takaful insurance, as more people seek financial protection for their families, businesses, and assets.

3. Regulatory Support and Standardization

Governments and regulatory bodies in countries like Malaysia, Saudi Arabia, and the UAE have introduced frameworks to support the growth of Takaful insurance. Standardization of Sharia-compliant practices and the establishment of dedicated regulatory authorities have boosted consumer confidence and market stability.

4. Technological Advancements

The integration of technology, such as artificial intelligence, blockchain, and digital platforms, has streamlined Takaful operations, making them more accessible and efficient. Insurtech innovations have enabled Takaful providers to offer personalized products, enhance customer experiences, and expand their reach to underserved populations.

5. Ethical Appeal to a Global Audience

In an era where consumers are increasingly conscious of the social and environmental impact of their choices, Takaful insurance stands out as a socially responsible option. Its emphasis on community welfare and ethical investments aligns with the values of a growing segment of the global population.

More Insights Of Full Report In Details:https://www.maximizemarketresearch.com/market-report/takaful-insurance-market/213737/

Segmentation Analysis

The Takaful insurance market can be segmented based on type, application, and region. Understanding these segments provides valuable insights into the market dynamics and opportunities for growth.

1. By Type

-

Family Takaful: This segment focuses on providing financial protection to individuals and their families in the event of death, disability, or critical illness. It is the largest and fastest-growing segment, driven by the increasing demand for life insurance products that comply with Islamic principles.

-

General Takaful: This segment covers non-life insurance, including property, motor, and health insurance. The growth of this segment is fueled by urbanization, infrastructure development, and the rising need for asset protection.

2. By Application

-

Personal: This includes Takaful products designed for individuals, such as health, education, and retirement plans.

-

Commercial: This caters to businesses, offering coverage for assets, liabilities, and employees. The growth of small and medium enterprises (SMEs) in emerging markets has significantly contributed to the demand for commercial Takaful.

3. By Region

-

Middle East & Africa: This region dominates the Takaful market, with countries like Saudi Arabia, the UAE, and Malaysia leading the way. The strong presence of Islamic finance institutions and supportive regulatory frameworks have propelled growth in this region.

-

Asia-Pacific: Countries like Indonesia, Pakistan, and Bangladesh are emerging as key markets for Takaful insurance, driven by large Muslim populations and increasing financial inclusion.

-

Europe & North America: While still a niche market, Takaful insurance is gaining traction in these regions due to the growing Muslim population and the ethical appeal of Islamic finance.

Country-Level Analysis

1. United States

In the U.S., the Takaful insurance market is still in its nascent stages but shows significant potential. The country is home to a diverse and growing Muslim population, estimated at over 3.5 million. As awareness of Islamic finance increases, more Americans are seeking Sharia-compliant financial products, including Takaful insurance. Additionally, the ethical and community-oriented nature of Takaful resonates with a broader audience, including non-Muslims who prioritize socially responsible investments.

2. Germany

Germany, with its sizable Muslim community of over 5 million, represents a promising market for Takaful insurance. The country’s robust regulatory environment and strong financial infrastructure provide a solid foundation for the growth of Islamic finance. However, challenges such as limited awareness and the dominance of conventional insurance providers remain. To tap into this market, Takaful operators must focus on education, partnerships, and tailored products that meet the unique needs of German consumers.

Competitive Analysis

The Takaful insurance market is characterized by the presence of both established players and new entrants. Key players include:

-

Saudi Arabian Cooperative Insurance Company (SAICO): A leading provider of Takaful insurance in the Middle East, offering a wide range of products for individuals and businesses.

-

Prudential BSN Takaful: A joint venture between Prudential plc and Bank Simpanan Nasional, this company is a major player in the Malaysian Takaful market.

-

Allianz SE: A global insurance giant, Allianz has entered the Takaful market through its subsidiaries, leveraging its expertise and resources to expand its reach.

Competition in the Takaful market is intensifying as providers focus on innovation, customer-centric products, and strategic partnerships. The integration of technology and the emphasis on ethical practices are key differentiators in this evolving landscape.

Conclusion

The Takaful insurance market represents a unique blend of tradition and modernity, offering a socially responsible alternative to conventional insurance. Its growth is driven by rising awareness of Islamic finance, economic development in emerging markets, and the ethical appeal of its principles. As the market continues to expand, Takaful operators must focus on innovation, education, and inclusivity to cater to a diverse and evolving customer base.

At its core, Takaful insurance is about more than just financial protection—it’s about fostering a sense of community, shared responsibility, and ethical stewardship. In a world where individuals are increasingly seeking meaningful and impactful financial solutions, Takaful insurance stands as a beacon of hope and resilience. Whether in the bustling cities of the Middle East, the vibrant communities of Southeast Asia, or the diverse neighborhoods of the West, Takaful is not just a market—it’s a movement towards a more equitable and compassionate future.

- Questions and Answers

- Opinion

- Story/Motivational/Inspiring

- Technology

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film/Movie

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News

- Culture

- War machines and policy