Egypt, the United Arab Emirates, and Saudi Arabia — the world’s biggest oil exporter — were among those invited last week to join the BRICS bloc of emerging markets, bringing the US’s top regional allies closer to China and Russia.

The trio were invited along with Iran, Argentina and Ethiopia at a summit in South Africa last week. They’re likely to become members at the start of next year. The leaders of the BRICS nations — Brazil, Russia, India, China and South Africa — are pushing to increase the group’s influence and counter US power over the global economy and trade, including through the role of the dollar.

For Egypt, Saudi Arabia and the UAE — long-standing strategic partners of Washington — the move underscores a determination to bolster their credentials as mid-sized powers. They want to focus on their economic interests, which are increasingly with China, rather than take sides in the great geopolitical standoff between the US and China and Russia.

“We want peace and prosperity and with that comes the economy and comes trade,” the UAE’s Economy Minister Abdulla bin Touq Al Marri said in an interview

While many will be quick to frame the BRICS enlargement particularly the addition of key US allies in the Middle East as a loss for the US-led Western order and win for China and Russia, the reality is not so black and white.

China and India are the top two trading partners for both Saudi Arabia and the UAE. Saudi trade with China and India reached a record of almost $175 billion last year, according to UN data compiled by Bloomberg. It was barely $5 billion at the start of the century.

Saudi Arabia's Trade With China Has Soared This Century

Source: UN, Bloomberg

Along with Russia, Saudi Arabia is China’s top oil supplier. China has established an exchange to trade oil in yuan but most analysts do not see Gulf countries abandoning the dollar anytime soon given that their currencies are pegged to the greenback and most of their imports are in the US currency — factors that have underpinned economic stability and growth.

“These countries are not seeking to get rid of their relationship with the US and completely pivot East but they do see their long-term political and economic interests with Asia and the global south,” said Anna Jacobs, a senior analyst at the International Crisis Group, referring to Saudi Arabia and the UAE.

Chart of the Week

For global oil markets, a US-Iran deal is already happening as American officials privately acknowledge a lighter touch in enforcing sanctions on Tehran’s oil sales.

Iran's Oil Exports Are Booming

Exports of crude and condensate from Iran

Source: Tanker Trackers

Iran has restored production to the highest level since the ban kicked in five years ago and is shipping its most crude to China in a decade. Iranian officials are confident they'll pump even more soon.

The Slant

The UAE's leadership at COP28 is controversial, but it's also a milestone, Ndileka Mandela writes for Bloomberg Opinion. Dismissing it outright could cripple pivotal global negotiations — especially those regarding the welfare of Global South nations on the frontlines of climate change.

Need to Know

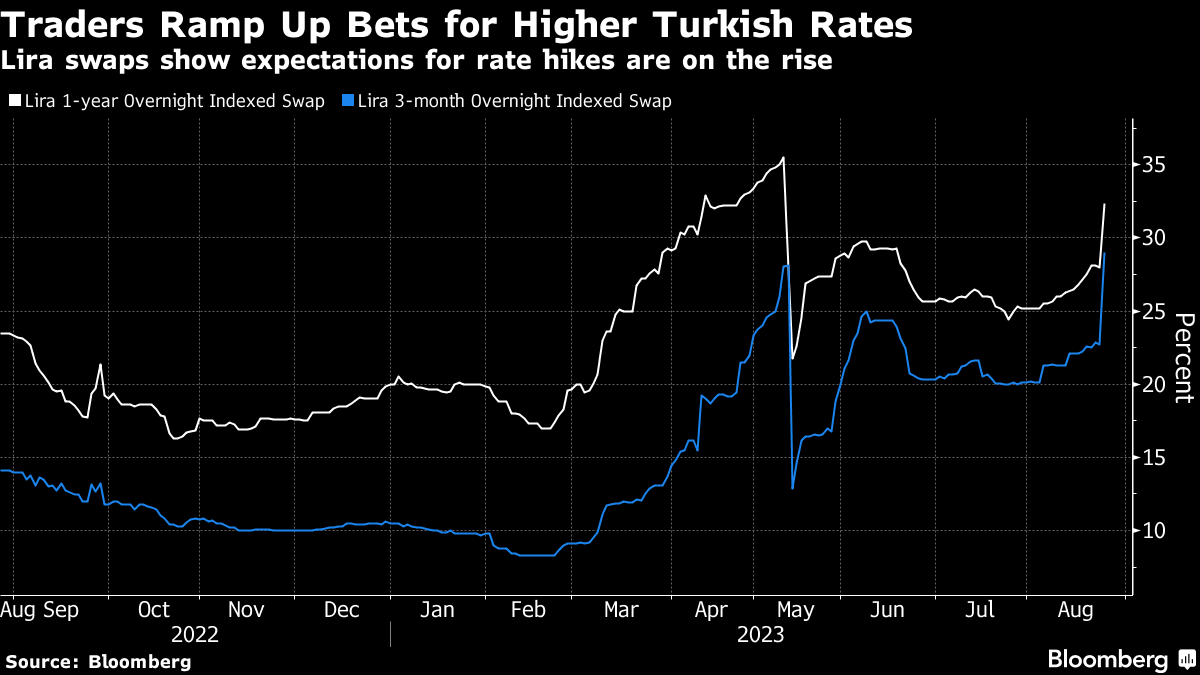

750 basis-point hike: Global banks from Morgan Stanley to Barclays and JPMorgan Chase say interest rates in Turkey will reach at least 30% by the end of the year — from 25% after last week's unexpectedly hawkish move — reflecting expectations of a massive shift from the central bank’s earlier guidance of “gradual” tightening.

Safe haven: Egypt’s benchmark stock index hit a record high, spurred by investors looking to hedge against surging inflation.

Growing India portfolio: Qatar's sovereign wealth fund invested $1 billion into the retail business of Asia's richest man, Mukesh Ambani. The deal came days after the QIA picked up a $474 million stake in billionaire Gautam Adani's green energy business.

Commodities magnet: Norilsk Nickel has established an office in Dubai, becoming the largest Russian metals and mining firm to set up in the UAE following the Kremlin's war in Ukraine.

Chinese buyers return: At Dubai's largest developer, buyers from the Asian nation doubled to 8% of the total during the first half of 2023 from 4% through 2022, according to a report. Meanwhile, Dubai is also predicting that air traffic from China will rebound strongly in the fourth quarter.

Saudi Aramco targeted: The oil giant is being investigated by the United Nations for possible human rights violations tied to fossil-fuel induced climate change.

Ties improving: Turkey and the US held their largest joint military exercises in at least seven years, as President Recep Tayyip Erdogan seeks another meeting with Joe Biden next month.

Fallout of "historic" meeting: Libya suspended its foreign minister after she met her Israeli counterpart in Rome. The two countries have no formal relations.